Which IRA is right for you? The difference between Roth and Traditional

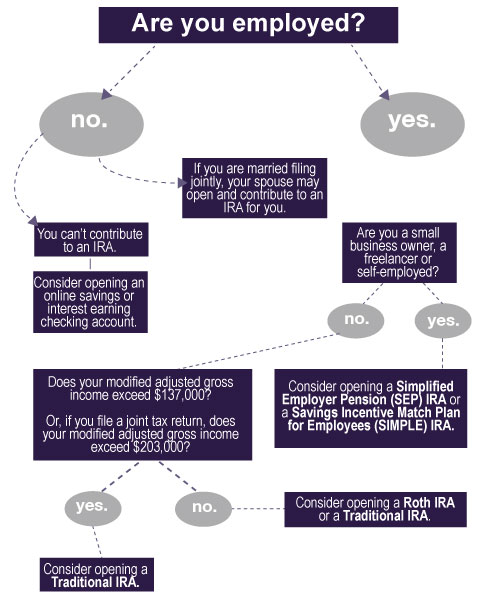

Before reading the article below, take a moment and answer the questions on the flowchart below. This will help determine which Individual Retirement Account (IRA) is right for you, and explain the difference between the two most common types; Roth and Traditional.

Now that you have a better understanding of what type of IRA may make the most sense for your situation, it’s time to understand them better. IRAs can be an important tool in your retirement savings belt, and whichever you choose to open could have a significant impact on how those accounts might grow.

Now that you have a better understanding of what type of IRA may make the most sense for your situation, it’s time to understand them better. IRAs can be an important tool in your retirement savings belt, and whichever you choose to open could have a significant impact on how those accounts might grow.

IRAs, or Individual Retirement Accounts, are investment vehicles used to help save money for retirement. There are two different types of IRAs: traditional and Roth. The biggest difference between a Roth IRA and a traditional IRA is how and when you get a tax break. The easiest way to understand this is contributions to traditional IRAs are tax-deductible, but withdrawals in retirement are taxable. Contributions to Roth IRAs are not tax-deductible, but the withdrawals in retirement are tax-free.

Traditional IRAs, created in 1974, are owned by roughly 35.1 million U.S. households. And Roth IRAs, created as part of the Taxpayer Relief Act in 1997, are owned by nearly 24.9 million households. Advice on what IRA to open typically begins with a question: do you think your tax rate will be higher or lower in the future?

Both kinds of IRAs share many similarities, and yet, each is quite different. Let’s take a closer look.

Traditional IRA

Up to certain limits, traditional IRAs allow individuals to make tax-deductible contributions into the retirement account. Distributions from traditional IRAs are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty. For individuals covered by a retirement plan at work, the deduction for a traditional IRA in 2021 has been phased out for incomes between $105,000 and $125,000 for married couples filing jointly and between $66,000 and $76,000 for single filers.

Roth IRA

Also, within certain limits, individuals can make contributions to a Roth IRA with after-tax dollars. To qualify for a tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½. Like a traditional IRA, contributions to a Roth IRA are limited based on income. For 2021, contributions to a Roth IRA are phased out between $198,000 and $208,000 for married couples filing jointly and between $125,000 and $140,000 for single filers.

Individuals who reach age 50 or older by the end of the tax year can qualify for annual “catch-up” contributions of up to $1,000. So, for these IRA owners, the 2021 IRA contribution limit is $7,000. Individuals under the age of 50 can contribute $6,000.

If you meet the income requirements, both traditional and Roth IRAs can play a part in your retirement plans. And once you’ve figured out which will work better for you, only one task remains: opening an account, which our financial advisors can help you do at any time.

If you meet the income requirements, both traditional and Roth IRAs can play a part in your retirement plans. And once you’ve figured out which will work better for you, only one task remains: opening an account.

Bob Skillings, Financial Advisor | 706 N German St. New Ulm, MN 56073; 877-794-6712; Direct: 507-233-5624; Fax: 507-233-5601; [email protected]

SouthPoint Financial Credit Union or any other entity appearing on this website is not affiliated with Cetera Advisor Networks LLC. *NOT AN NCUA/NCUSIF INSURED, NOT A DEPOSIT, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NO CREDIT UNION GUARANTEE, MAY LOSE VALUE.

*Consult your legal or tax counsel for advice and information concerning your particular circumstances. Neither Cetera Advisors Networks LLC nor any of its representative may give legal or tax advice. **Securities and investment advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC, a Broker-Dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.

Some IRA’s have contribution limitations and tax consequences for early withdrawals. For complete details, consult your tax advisor or attorney. Distributions from traditional IRA’s and employer sponsored retirement plans are taxes as ordinary income and, if taken prior to reaching age 59 1/2, may be subject to an additional 10% IRA tax penalty. To qualify for the tax-free and penalty-free withdrawal or earnings, a Roth IRA must be in place for at least five tax years, and the distribution must take place after age 59 1/2 or due to death, disability, or a first time home purchase (up to a $10,000 lifetime maximum). Depending on state law, Roth IRA distributions may be subject to state taxes.