Reasons to start a 529 Plan on 5/29

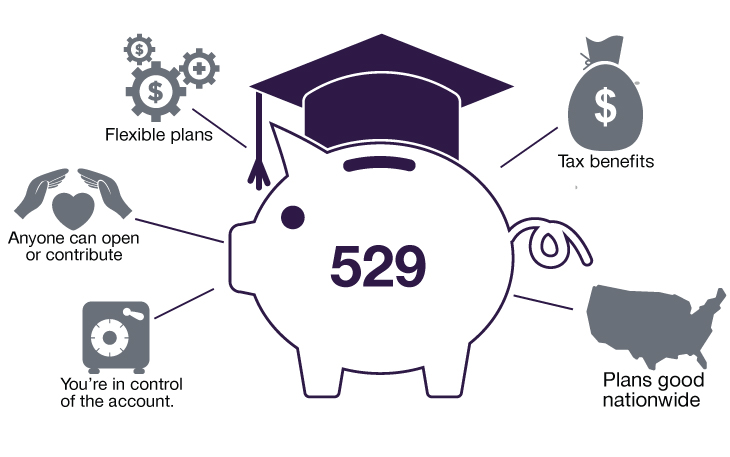

As you save for college, it’s vital to put time on your side. While it’s never too late to contribute to a 529 Education Savings Plan, the earlier you save, the more time the fund has to grow and compound.

As a financial advisor, I often see people open a 529 Plan, make their initial contribution when their child/grandchild is quite young and go years without making another deposit. When the child enters middle or high school, the panic button goes off and it’s time to play catch up and start frantically contributing to the account. Sometimes, guilty feelings about the financial progress they could have made if they started earlier creep up.

The reality is there’s no such thing as education planning starting too early

The key is to contribute as early and as often as you can to your 529 plan. The price of college has increased more than 25% in the last ten years(1). During the 1978-79 school year, CNBC reports it cost the modern equivalent of $17,680 per year to attend a private college and $8,250 per year to attend a public college. By the 2008 – 2009 school year those costs had grown to $38,720 at private colleges and $16,460 at public colleges. Today, those costs are closer to $48,510 and $21,370, respectively. That means costs increased by roughly 25.3% at private colleges and about 29.8% at public colleges.

These eye-opening statistics underline the importance of making yearly, or even monthly, contributions to your child or grandchild’s college savings plan. A 529 plan is one of the biggest investments in their future, and what investment could be more important?

I am happy to help you plan these monthly contributions. I’m confident that we can arrange them in such a way that will not impact your family’s budget or standard of living.

Don’t get into a situation where you live with a guilty conscience or feelings of regret. The minimum investment deposit for a 529 Plan is just $50. Get ahead of it and do the right thing by contributing early and often to your child or grandchild’s 529 plan today.

Bob Skillings, Financial Advisor | 706 N German St. New Ulm, MN 56073; 877-794-6712; Direct: 507-233-5624; Cell: 507-217-9038; Fax: 507-233-5601; [email protected]

SouthPoint Financial Credit Union or any other entity appearing on this website is not affiliated with Cetera Advisor Networks LLC. *NOT AN NCUA/NCUSIF INSURED, NOT A DEPOSIT, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NO CREDIT UNION GUARANTEE, MAY LOSE VALUE.

*Consult your legal or tax counsel for advice and information concerning your particular circumstances. Neither Cetera Advisors Networks, LLC nor any of its representative may give legal or tax advice. **Securities and investment advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC, a member FINRA/SIPC, a Broker-Dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.

Investors should consider the investment objectives, risks, charges and expenses associated with municipal fund securities before investing. This information is found in the issuer’s official statement and should be read carefully before investing. Investors should also consider whether the investor’s or beneficiary’s home state offers any state tax or other benefits available only from that state’s 529 Plan. Any state-based benefit should be one of many appropriately weighted factors in making an investment decision. The investor should consult their financial or tax advisor before investing in any state’s 529 Plan. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Advisor Networks LLC nor any of its representatives may give legal or tax advice.

SIPC: sipc.org | FINRA: finra.org | Privacy Policy: ceteraadvisornetworks.com/privacypromise | Important Information: ceteraadvisornetworks/importantdisclosures | FINRA Brokercheck: http://brokercheck.finra.org.

1- www.cnbc.com/2019/12/13/cost-of-college-increased-by-more-than-25percent-in-the-last-10-years.html [12/13/19]