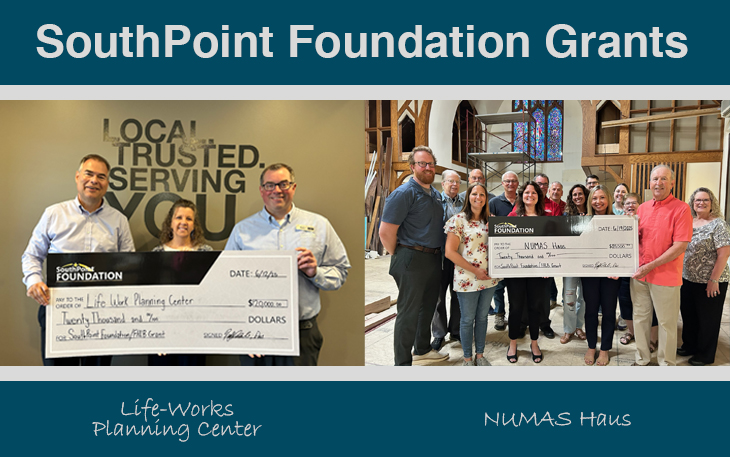

SouthPoint Foundation Awards Two Grants of $20,000

(Sleepy Eye, MN – July 9, 2025) SouthPoint Financial Credit Union Foundation is proud to announce that both Life-Works Planning Center and NUMAS Haus have been selected to receive grants of $20,000 each. These awards were made possible through our collaboration with the Federal Home Loan Bank of Des Moines (FHLB) and its Member Impact Fund matching grant program.

We are honored to continue our partnerships with both organizations and to support their vital missions. Life-Work Planning Center has been empowering Minnesota’s Displaced Homemakers and Women in Transition for over 40 years, helping women and their families achieve greater self-sufficiency through personal growth and development. Their work spans eight counties and addresses the unique barriers women face in the workforce. Meanwhile, NUMAS Haus provides safe shelter and comprehensive support services to homeless women and children in Brown County. With a structured 90-day program and extended case management, NUMAS Haus helps families build stability and independence through access to education, employment, housing, and mental health resources. We are proud to stand beside these organizations as they continue to make a meaningful difference in our communities.

We extend our sincere thanks to the FHLB and the Member Impact Fund for their generous support of initiatives that strengthen the communities we serve.

FHLB Des Moines provides funding solutions to more than 1,200 members to support mortgage lending, economic development and affordable housing in the communities they serve. The Member Impact Fund provides FHLB Des Moines members up to $3 for every $1 in matching grant donations to strengthen the ability of not-for-profits or government entities to support the needs of their communities.

“The Member Impact Fund continues to be a powerful resource in supporting our members as they expand access to affordable housing and drive community development,” says Kris Williams, president and CEO of FHLB Des Moines. “It’s inspiring to see the partnerships centered around improving local communities in such a variety of ways.”

Recipient organizations were selected based on the needs for grant funding to support capacity-building or working capital necessary to strengthen their ability to serve affordable housing or community development needs including job training, affordable housing, financial literacy, food banks and youth programs.

This member matching grant program is part of FHLB Des Moines’ ongoing mission to offer a variety of funding options through its members.

Since its founding in 2023, the Member Impact Fund has supported affordable housing and community development with nearly $70 million in grants awarded by FHLB Des Moines. Member institutions apply and receive Member Impact Fund matching grants to be distributed to eligible organizations alongside their own grant contribution.

SouthPoint Financial Credit Union Foundation is a registered 501c3 not-for-profit corporation established in 2017 to promote community giving and scholarship opportunities in the areas served by SouthPoint Financial Credit Union. Visit southpointfinancial.com/southpoint-foundation-2 for more information.

About Federal Home Loan Bank of Des Moines

The Federal Home Loan Bank of Des Moines is deeply committed to strengthening communities, serving 13 states and three U.S Pacific territories as a member-owned cooperative. We work together with over 1,200 member institutions to support affordable housing, economic development and community improvement.

FHLB Des Moines is one of 11 regional Banks that make up the Federal Home Loan Bank System. Members include community and commercial banks, credit unions, insurance companies, thrifts and community development financial institutions. FHLB Des Moines is wholly owned by its members and receives no taxpayer funding. For additional information about FHLB Des Moines, please visit www.fhlbdm.com.